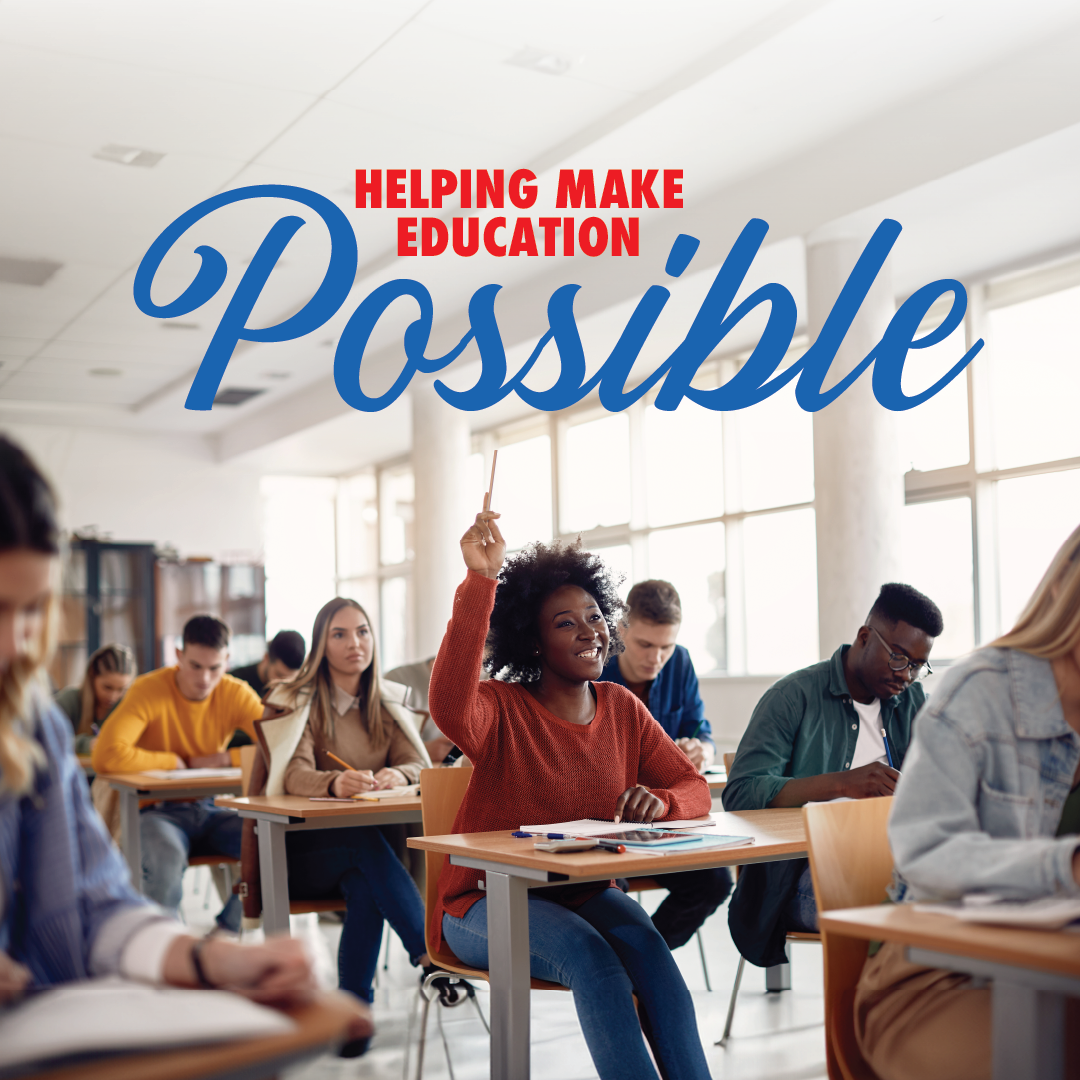

Donations made by individuals are a huge part of the funding income for the Foundation for Leon County Schools. With the support of individuals, we are able to provide additional resources to the students and teachers in Leon County Schools.

Your donation will directly impact literacy in all parts of our community by closing the gap on the number of books in our elementary schools. In addition to donating NEW books at any Capital City Bank location or Midtown Reader through November 30, your monetary contribution made directly to the Foundation for Leon County Schools will enable Leon County Title I elementary schools to purchase books that meet the needs of their school community. The Big Book Give was organized by Leon County School Board member Alva Smith and supported by KPMG.

Planned Giving is the process of arranging a contribution that will be allocated at a future date. Most often granted once the donor has passed away, planned gifts are usually donated through a will or trust.

If you would like additional information about planned giving, please contact Margaret Farris at (850) 487-7241.

Planned Giving most often takes one of four forms: bequests, charitable gift annuities, trusts, and pooled income funds. Learn more about each option below.

Bequests – 90% of planned gifts take the form of bequests; legacy gifts left to a nonprofit after a donor has passed away, for which the donation process is relatively straightforward. A donor can make a charitable bequest via a trust, will, or estate plan.

Charitable Gift Annuities – A somewhat more complicated process, charitable gift annuities are contracts between a donor and a nonprofit in which the donor gives a large amount of money in exchange for the nonprofit’s promise to pay the donor a fixed annual income for life, or some other mutually agreed-upon period of time. During this time, the nonprofit is able to invest the money and grow income through it. Once the pay period ends, the nonprofit retains any remaining funds. Because charitable gift annuities involve a back-and-forth process that happens over time, they must be thought of as an ongoing event rather than a one-time occurrence.

Trusts – There are several types of trust, but each share the basic principle that recipients are given a certain amount of money from the trust annually until its completion. These fall into two main categories, Charitable Remainder Trusts and Charitable Lead Trusts. Charitable Remainder Trusts are irrevocable trusts that pays a specified annual amount to the recipient for life, or another fixed period of time. At the end of the term, the remaining trust assets are transferred to the charity. This type of trust can be structured as either an annuity trust which pays out a fixed amount to the recipient each year, or a unitrust, which pays out a fixed percentage of the trust value which is recalculated annually. Charitable Lead Trusts are similar to charitable remainder trusts, but annual payments are given to a nonprofit rather than the donor, and the principal reverts to the donor or their designated beneficiaries at the end of the trust term.

Pooled Income Funds – A pooled income fund is a trust that is established and maintained by a public charity, and operates similarly to a charitable remainder mutual fund. Individual donors contribute to the fund, which combines them for investment purposes. Each year, the fund’s net investment income is distributed among fund participants, proportionally to their investment. Such distributions occur throughout the donor’s lifetime, after which the portion of fund assets attributable to that donor is removed from the fund and transferred to the organization.